- 🗞 News

- Last updated: Apr 13, 2023

- 7 Min Read

Behind the Scenes of a Customer Focussed Car Finance Company

Written by

Verified by

See how much you can borrow in 60 seconds

| Representative Example | |

|---|---|

| Loan amount | £10,000 |

| Interest rate | 13.9% APR |

| 54 payments of | £246 |

| Total cost of credit | £3,284 |

| Option to purchase fee | £1 |

| Total payable | £13,285 |

Starting a company can definitely be daunting, especially when you're going into an industry that's so big. That's why Carmoola made the vital choice to do extensive customer research before launching, so that we knew exactly what our product needed to be. Carmoola's CEO, Aidan, found that the research emphasised that: certain customers felt that they weren't being made a priority. There was a space for disruption in the car finance market.

Let's back track to the beginning... being a startup, we're a small team, and being a small team we've had the opportunity to really focus on understanding our customer's needs. This was a vital part of the design of our app and website. We wanted to ensure that we brought a 'customer first' design to the motor finance industry 🚘 The core to this design process was understanding our customers' needs.

Pre launch: customer research findings 🔍

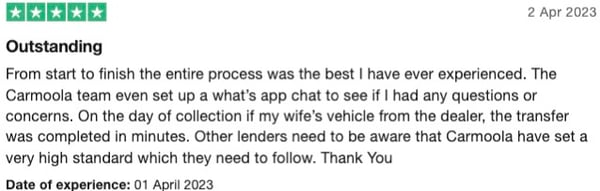

In the research one of the findings was that some customers had experienced bad communication when using car finance in the past. We've made it a priority that our customers know the details of financing with us, we want our customers to feel understood and be in control. A clear understanding is especially important when a customer is looking to purchase an expensive product such as a car. We've made it our responsibility to ensure communication is clear to our customer, such as details of the product they are getting, how much they are paying for it and what they will have at the end of the product. Our app is also perfect for customers if they aren't too keen to chat on the phone as there is the option to email us or WhatsApp us 🕺

Another finding was that some customers in the past had a negative experience with the process of getting their car. They mentioned that there was a load of paperwork, weeks of review and constant interaction from customer service agents. A few even said that they were left feeling irritated and didn't want to go through the process again 😕

The Carmoola experience

After the extensive research we wanted to ensure that when we launched, our process at Carmoola was different to the experiences of some customers mentioned above.

We process everything online so you don’t have to talk to anyone on the phone or go to an office to personally submit the requirements (but if you're in the mood for a chat our support team is there to talk to you everyday!) 😎 We cut down our process into 3 steps:

- See how much you can borrow ✅

- Check your car’s history ✅

- Pay with your Carmoola card ✅

All you need to do is download the app and you'll be able to get a budget in 60 seconds! It only takes a few questions, and you’ll find out how much you can borrow on car finance, allowing you to shop with confidence.

The entire process takes 3 minutes to complete, including the ID verification step and adding in your car details! Which then reveals your shiny new virtual card, that you can use online or over the phone.

One of our goal has been flexibility, so we added a feature where our customers can change their repayment date on the app yourself to a date that suits them 🥰

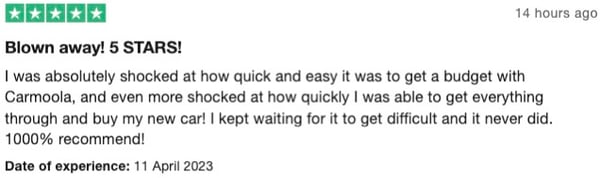

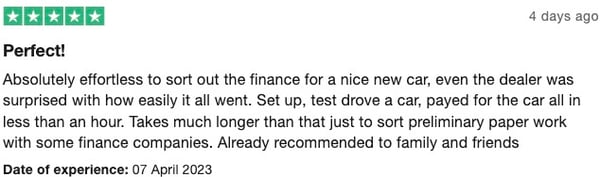

Fast forward to today, April 2023. It's been just over a year since Carmoola was launched... and I reckon we're even more customer focused than before. Since this launch we've had over 500 reviews on TrustPilot. Here are some recent favourites that make us so happy to see from our amazing customers, these reviews make us so thrilled to see that we've been able to help so many happy customers buy the car of their dreams 💕

In the office, we love to chat. Ranging from professional chats through to our brutal banter. One topic no matter the time or the day will always be our customers, when there's a problem, a review, or a new customer who's just bought a car, we all will discuss it. I write content and implement SEO, aka I don't handle our customers directly, yet I know many of our customers first and last names from memory and this is purely because of the chats in the office. My team put in their absolute all everyday to ensure that our customers experience buying a car with us is an amazing one 💃

Again, I don't handle our customers directly, however from what I've heard and seen here at Carmoola we have three different types of customers ✅

1. The 'fast (and furious)' customers 🚘

These customers are fast, they're at the head of the race, aiming to see how quick is quick when buying a car, and with us it's QUICK! The quickest time from downloading the app through to purchasing their car is FIFTEEN minutes. These customers tend to keep any questions to a bare minimum and try to buy their new car as quickly as they can with zero disturbances, just like Dom 😉

2. The are 'we done already?' customers 🚘

These customers are a bit more uncertain about the Carmoola process, they'll call and email often, just to double check they're following the steps accordingly and not missing out on anything. A common question is 'is that all I need to do?' and most often the answer is...'yes that's all' 🥰

3. The 'banter is where it's at' customers 🚘

These customers love to have a quick chat with our team, and let me tell you it always makes our day when we hear the operations team have a giggle, the laughs are contagious and soon everyone in the office is having a small giggle! They're keen to hear about the teams day and how we're getting on, they buy their car but keep us informed of their journey, and we're here for it 🕺

I'll let you in on a little secret though, whether a customer falls into any of the above categories or doesn't at all, our whole team is so incredibly grateful to every single customer for letting us help them to buy their dream car 🥰

This also goes the other way...being only one year old we still run into errors and are finding ways to improve. So if/when a customer has an issue we really take it to heart. We want to make their journey with us as easy as possible and if they've run into any hurdles we try our outmost to resolve any issues! A big value here at Carmoola "love to grow" and we take all feedback and communication whether it be good or bad, as an experience to grow from, a value that always reminds us there is more to achieve, and more to learn 🤓

As our company grows, both from a customer and employee standpoint I am so excited to see how and what we have learn along the way. I am also intrigued to see whether we have a couple new additions to the different types of customers... so watch this space for an update 😉

What 'type' of customer do you reckon you fall into? Get involved in the comments down below! 👇

See how much you can borrow in 60 seconds

| Representative Example | |

|---|---|

| Loan amount | £10,000 |

| Interest rate | 13.9% APR |

| 54 payments of | £246 |

| Total cost of credit | £3,284 |

| Option to purchase fee | £1 |

| Total payable | £13,285 |

Related articles

What to Do If Your Car on Finance Is Broken Beyond Repair

Your car’s dead, the repair bill’s sky-high, or insurance has called it a write-off. But the finance payments? Still ticking...

What Are the Top 5 Used Car Websites in the UK?

Thanks to the internet, searching for a used car in the UK is easier than ever before. You can simply head online, visit a used...

What Is GMFV in PCP Car Finance? Guaranteed Minimum Future Value Explained

GMFV, or Guaranteed Minimum Future Value, is the amount your lender estimates your car will be worth at the end of your PCP...

.webp?width=832&height=592&name=customer-support%20(1).webp)

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)