- 🗞 News

- Last updated: Mar 28, 2024

- 3 Min Read

Enhancing Customer Experience: Carmoola's Journey in Customer Segmentation

Written by

Verified by

See how much you can borrow in 60 seconds

| Representative Example | |

|---|---|

| Loan amount | £10,000 |

| Interest rate | 13.9% APR |

| 54 payments of | £246 |

| Total cost of credit | £3,284 |

| Option to purchase fee | £1 |

| Total payable | £13,285 |

In the ever-evolving landscape of financial services, understanding customers is paramount.

At Carmoola, we’ve recently embarked on an exciting project to redefine our customer segmentation, with the aim of continuing to differentiate the product experience and further elevate our marketing strategy.

Customer first focus

Customer segmentation isn't a new concept of course, but at the core of this initiative lies a simple belief: our customers matter. We acknowledge that behind every transaction is a real person with distinct circumstances and aspirations. By delving into a truly data-driven customer segmentation, we aim to forge stronger connections with our users, and enhance their overall experience of using Carmoola to find and finance their dream cars.

How we defined the segments

We had initial customer personas that were first identified when we were developing the product a few years ago, but we wanted to validate these segments using a more robust data-driven approach.

At the end of last year, we conducted a big piece of customer research to better understand the needs, wants and attitudes of 5 distinct segments, which we then analysed against our own customer datasets to provide rich behavioural insights that we could continually measure over time.

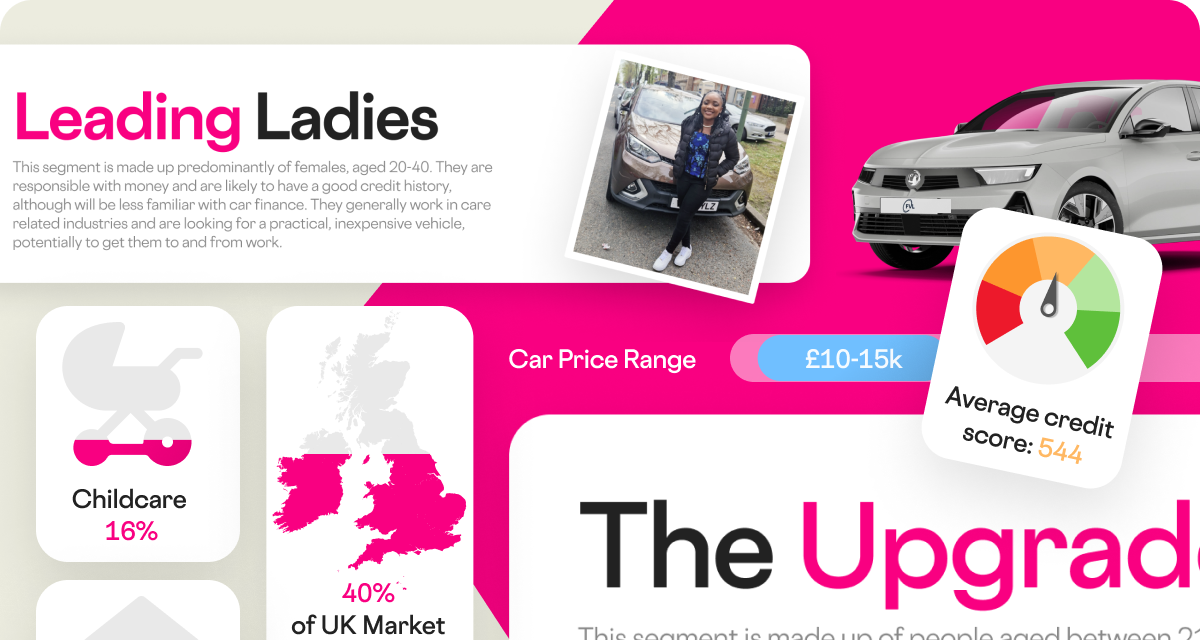

Zoning in on "Leading Ladies"

One distinct segment that has emerged is the group we refer to as "Leading Ladies". This segment represents a significant proportion of our customer base (27%) and is made up of hard working, young professionals who are typically looking for a practical and affordable vehicle, often playing an important role in getting them to and from work.

Through this project, we were able to clearly observe and understand different triggers, barriers and needs throughout the car buying process.

Leading Ladies, for example, tended to feel more anxious when it came to choosing car finance and far less confident throughout the car buying process, underscoring the importance of catering to their specific needs and concerns.

Moreover, Leading Ladies highly value the feeling of being in control. They seek transparency, flexibility, and personalised guidance in their financial decisions. For Carmoola, this presents an opportunity to empower Leading Ladies by providing them with the tools and resources they need to make informed choices.

Building inclusivity from the ground up

The significance of Carmoola's customer segmentation extends beyond the company. In an industry where traditional lenders often view customers merely as a walking credit score, our approach represents an opportunity to serve typically ignored customer segments by considering them as whole people, not just ratings and numbers.

By understanding and catering to the needs of our customers, we are paving the way for a more inclusive financial ecosystem, addressing the knowledge imbalance that exists between buyers and sellers, and helping to empower consumers.

By embracing diversity and leveraging data-driven insights, we are redefining not just car buying, but financial services in general. As we continue to innovate - through our product, our lending criteria, and even our commercial model - one thing remains clear: at Carmoola, the customer always comes first.

See how much you can borrow in 60 seconds

| Representative Example | |

|---|---|

| Loan amount | £10,000 |

| Interest rate | 13.9% APR |

| 54 payments of | £246 |

| Total cost of credit | £3,284 |

| Option to purchase fee | £1 |

| Total payable | £13,285 |

Related articles

Can you drive in the UK on a foreign licence?

If you’re new to the UK, you might be keen to get behind the wheel to explore on the open road. You can usually drive in the UK...

What happens if my car is written off and it’s still on finance?

Accidents happen. When split-second decisions and challenging conditions make driving difficult at the best of times, even the...

Which credit reference agencies do lenders use?

When applying for car finance, your credit score can make a significant difference to the APR you’re offered, your repayment...

.webp?width=832&height=592&name=customer-support%20(1).webp)

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)