- Carmoola

- Blog

- Car Finance

- PCP vs leasing: Which is better?

- 🗞 Car Finance

- Last updated: Mar 18, 2025

- 5 Min Read

PCP vs leasing: Which is better?

Written by

Verified by

See how much you can borrow in 60 seconds

| Representative Example | |

|---|---|

| Loan amount | £10,000 |

| Interest rate | 13.9% APR |

| 54 payments of | £246 |

| Total cost of credit | £3,284 |

| Option to purchase fee | £1 |

| Total payable | £13,285 |

If you’re looking into your options for car financing, it can be confusing. Personal Contract Purchase (PCP) and leasing both give you access to a car in return for monthly repayments, and both come with the option to hand back the car and walk away with no further obligations at the end of your agreement. So how do you choose which is best?

It really depends on what you’re looking for: a PCP agreement will give you flexibility, while leasing could be a lower-cost option. We’re here to help you work out the differences, and find the best fit for you and your finances.

What is PCP?

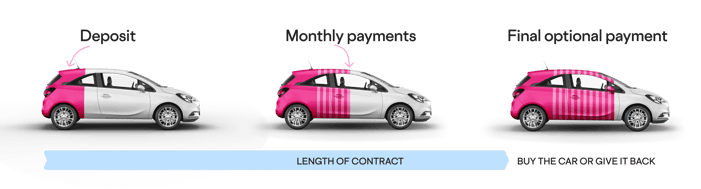

Personal Contract Purchase, or PCP, spreads the cost of buying your car over a set period of time, usually between two and four years. It’s a flexible method of car financing, as it gives you options at the end of your agreement:

- Pay a final balloon payment, and become the car’s legal owner

- Hand the car back to the lender and walk away

- Use any positive equity towards an agreement on a new car

As well as this flexibility, PCP agreements typically offer lower monthly payments compared to some other finance options, making them a popular choice.

Pros of PCP

- Lower monthly payments than hire purchase or personal loans.

- Flexibility at the end of the agreement. You can choose to keep, return, or trade in your car.

- The option of a new car every few years.

Cons of PCP

- You’re not the car’s legal owner unless you pay the balloon payment at the end.

- You may face extra charges for damage or excess mileage.

- If you miss payments, you could lose the car and affect your credit rating.

What is leasing?

Leasing, sometimes known as Personal Contract Hire or PCH, is the long-term rental of a car over a set term. It generally doesn’t offer an ownership option at the end of the agreement term, and so can be a great choice for those who like the idea of having a new car every few years without worrying about the long-term maintenance and depreciation that comes with car ownership.

Pros of leasing

- Ideal if you like having the latest model and want to upgrade every few years.

- When your lease term is up, you’ll have options to either start a new lease on a different car, or walk away entirely.

- You won’t have to worry about depreciation tied up in the car.

- Special rates can apply if you’re using the car for business purposes.

Cons of leasing

- There’s no ownership option, so even if you fall in love with your car, you’ll most likely have to give it back.

- You may face extra charges for damage or going over your mileage limit.

- If you miss payments, you could lose the car and affect your credit rating.

Which is right for you?

There’s no right answer for whether PCP or leasing is better; the right option is always the one that fits your budget and goals best.

PCP could be the best choice if you’re not sure whether you’ll want to eventually own your car or not, and you won’t have to decide until the end of your agreement, in two, three or four years’ time. There can be more interest to pay as this will be based on the car’s initial purchase price. You’ll also have the right to voluntarily terminate your agreement and hand the car back early if you struggle to keep up with payments. You’ll need to pay 50% of the Total Amount Payable (including fees and interest) and hand the car back to the lender, and there may be additional fees if you’ve gone above the agreed mileage limits and have damage beyond the normal boundaries of the lender’s ‘wear and tear’ policy.

Leasing is a flexible option if you prefer to change cars every few years or want to avoid the additional responsibilities that come with ownership (although you’ll usually need to cover MOT, servicing, and maintenance costs). Typically, it offers lower repayments than PCP, as payments are based purely on the value that the car will lose during your lease term, but you’ll be tied into a longer-term contract which can be expensive to end early.

By law, both options will offer a 14-day cooling-off period once you’ve signed your agreement, but beyond that period, cancelling your agreement can come at a cost and could have a negative impact on your credit score.

FAQs about PCP and car leasing

Will my PCP agreement come with a mileage limit?

What do I need to apply for PCP finance?

Do I need a credit check for PCP finance?

Yes, you’ll usually need to undergo a credit check for any type of finance, including PCP. Lenders will often carry out a soft credit check to assess your initial eligibility, followed by a hard credit check (which will be listed on your credit file).

See how much you can borrow in 60 seconds

| Representative Example | |

|---|---|

| Loan amount | £10,000 |

| Interest rate | 13.9% APR |

| 54 payments of | £246 |

| Total cost of credit | £3,284 |

| Option to purchase fee | £1 |

| Total payable | £13,285 |

Related articles

Hire Purchase vs leasing: Which is better?

If you're considering car finance options, you've likely come across Hire Purchase (HP) and leasing. Both are popular choices and...

What’s the difference between car leasing and subscriptions?

Looking for a new car, but not sure about committing to actually buying and owning one? It makes sense - our attitude to owning...

Car finance vs leasing: Which is better?

If you're considering how to fund your next vehicle, understanding the differences between car finance (HP and PCP) and leasing...

.webp?width=832&height=592&name=customer-support%20(1).webp)

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)