See if you can switch and save with Carmoola and thank us later.

Takes 60 seconds, no impact on your credit profile to see if you're approved 👍

Representative 13.9% APR

Car refinance is the process of taking out a new finance agreement so you can pay off your current loan and switch to a new lender, usually with lower rates and better terms.

STEP 1

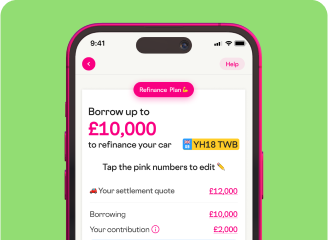

Answer a few questions about your car mileage and settlement quote from your current lender

STEP 2

After a few questions in our app you’ll find out if you’re eligible and your new rate and budget for refinancing

STEP 3

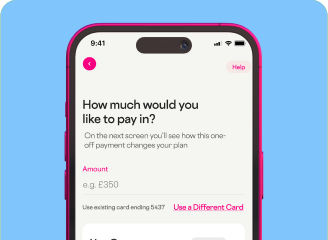

Simply pay your settlement quote with your Carmoola card or by bank transfer, all from your smartphone

Is there anything better than saving money (apart from unlimited ice cream? Just us?). The prospect of being able to save some pounds is one of the biggest reasons people decide to refinance.

It’s worth noting that saving is not guaranteed, it will depend on what your current deal looks like and how your circumstances have changed since you signed your first agreement. The finance agreements available to you will also be affected by wider market conditions, which can impact the APRs on offer.

The good news is that if you’ve improved your credit score, you might qualify for a lower interest rate that will save you money in the long run. The even better news is, Carmoola can help.

Anyone can switch their existing car loan by getting an early settlement quote. With Carmoola, you can switch in 8 minutes, all from your smartphone.

Refinancing can unlock savings by restructuring your loan with a lower interest rate or better terms.

Our friendly, UK-based team is here from 8am - 9pm EVERY day, via WhatsApp, email, SMS or phone.

Missed a payment? You can catch up easily in our app and even make overpayments with no fees.

“The easiest application for car finance I’ve ever had. Even the garage I purchased from was impressed at how quick the process was! Would recommend to anyone.”

“This is the best car finance company I’ve ever dealt with, they are the meaning of hassle free and I can guarantee they’ll be lower than you current finance on interest rates.”

“Went from a few questions answered honestly and quickly over whatsapp. To signing my refinance agreement and my existing finance company getting paid in under 2 hours. Simple, easy and stress free experience.”

“Applied for finance and literally was asked a few questions the day after to clarify some things. The same day I went through the dealership and car was ready to drive home the same day. Superb company and communication and the app is great.”

“Easy to use the app and very helpful staff. I also was given the best deal that nobody else could offer me. Thanks team Hanan, Kayleigh and Tom.”

Need to make a change now? You can apply to refinance your current car deal at any time. That said, it’s worth keeping in mind that some lenders will ask that you’ve had your existing loan for a set period (usually at least 12 months) before looking to switch things up.

Credit scores are affected by a whole host of different things, but refinancing will usually lower your score in the short-term. That’s because your new deal will be considered a new account on your credit report while also adding a new hard search and reducing the average age of your credit.

Don’t worry; this decrease should only be temporary. Once you start making your new loan repayments, your score will start to recover. In fact, if your new deal comes with more affordable repayments – and reduces the chances that you’ll miss a payment – refinancing could even improve your credit score over time.

Bad credit scores can happen for a range of different reasons. There’s no judgement here; if you’ve missed payments in the past, you might still be able to refinance.

Your options may be more limited and you’re unlikely to have access to the lowest APRs, but there are lenders who specialise in bad credit car finance. You could switch to a loan with a longer term and lower repayments (paying more interest over time) or refinance your PCP balloon payment.

When applying to refinance your car, you’ll likely need to provide:

What would you like to do first?

Takes 60 seconds, no impact on your credit profile to see if you're approved 👍

Rates from as low as 6.9% APR, Representative 13.9% APR