Refinancing? We can help.

See if you can switch and save with Carmoola and thank us later.

Switch and SaveTakes 60 seconds, no impact on your credit profile

to see if you're approved 👍

Representative 13.9% APR

What is car refinancing?

Refinancing involves you taking out a new finance agreement so you can pay off your current car loan and switch to a new lender, usually with lower rates and better terms.

How does refinancing work?

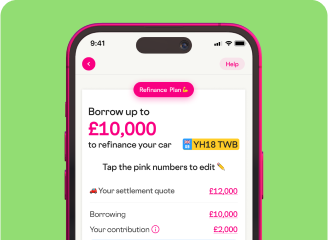

STEP 1

Tell us about your finance

Answer a few questions about your car mileage and settlement quote from your current lender

STEP 2

Get a new rate and budget 👍

After a few questions in our app you’ll find out if you’re eligible and your new rate and repayments

STEP 3

Refinance your deal 💸

Simply pay your settlement quote with your Carmoola card or by bank transfer, all from your smartphone

Could refinancing save me money?

Is there anything better than saving money (apart from unlimited ice cream? Just us?). The prospect of being able to save some pounds is one of the biggest reasons people decide to refinance their car loan.

It’s worth noting that saving is not guaranteed, it will depend on what your current deal looks like and how your circumstances have changed since you signed your first agreement. The finance agreements available to you will also be affected by wider market conditions, which can impact the APRs on offer.

The good news is that if you’ve improved your credit score, you might qualify for a lower interest rate that will save you money in the long run. The even better news is, Carmoola can help.

What are the pros and cons of refinancing?

Benefits 💸

- Secure a lower interest rate

If your credit score has improved since taking out your current loan, you may qualify for a more competitive interest rate. This reduction can translate to savings over the life of the loan. - Reduce monthly payments

Refinancing with a longer loan term can decrease your monthly payments. However, it's essential to understand that extending the loan term will generally result in paying more interest in the long run.

Things to consider 🤔

- Early repayment fees

Review your current car finance agreement for any penalties associated with early repayment. These fees can potentially reduce the benefits of refinancing. - Interest rate fluctuations

Monitor current interest rates and compare them to your existing rate. Refinancing may not be worthwhile if new rates are higher than your current one.

Car refinance calculator 🧮

Thinking about refinancing? See if you can drive away with a better deal.

Your existing finance 🕸

Add details about your current car finance agreement

Customise your

new finance deal ✨

Tweak your contract length and credit profile to see what your new monthly repayments might look like

Your new monthly payments

You could reduce your

monthly payments by £443 🙌

Download the Carmoola app to get your

personalised refinance quote, and see how much

you could save!

For illustration purposes only. The rate and budget you may be offered will be based on your individual circumstances. This is not an offer or a quote for finance.

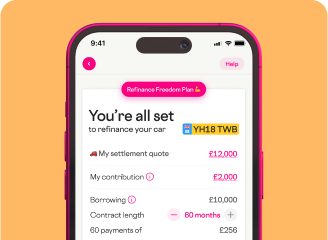

Representative Example

Borrowing £10,000 over 54 months with a representative APR of 13.9%, an annual interest rate of 13.9% (Fixed) and a deposit of £0.00, the amount payable would be £246 per month, with a total cost of credit of £3,284 and a total amount payable of £13,285, including a one-off Option to Purchase fee of £1.

We offer hire purchase and personal contract purchase loans between £2,000 - £55,000 at a personalised APR between 6.9% and 29.9%.

Why switch to Carmoola?

Anyone can switch their existing car loan by getting an early settlement quote. With Carmoola, you can switch in 8 minutes, all from your smartphone.

Switch and save

Refinancing can unlock savings by restructuring your loan with a lower interest rate or better terms.

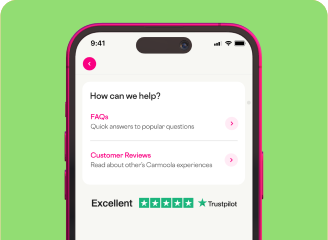

5 ⭐️ support

Our friendly, UK-based team is here from 8am - 9pm EVERY day, via WhatsApp, email, SMS or phone.

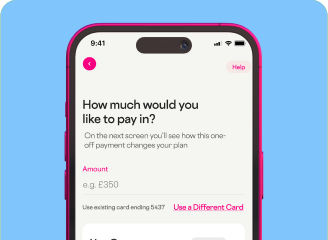

Payment flexibility

Missed a payment? You can catch up easily in our app and even make overpayments with no fees.

Don’t just take our word for it

“Such a simple way to get car finance and at a good rate too. Easy to use app with step by step process. Love the finance calculator, which allows you to adjust the amounts and see the payments instantly. Would definitely recommend!”

Simon.

“Easy to use and to get a budget with their online calculator! The best part is the flexibility, you can choose how much within your allocated budget and for how long to repay. Will defo use again in the future. *****”

Dean

“Absolutely amazing service, super quick to respond and it couldn’t have been easier, I would 100% recommend Carmoola to anyone!”

Joanne

“Not just a normal car Finance company!! Very fast and efficient and they make you feel like a valued family member, lots of unexpected after sales benefits that have been very much welcomed and appreciated too!!”

Burrow

“Incredible experience! Omg! The way forward in car finance. I’d use these guys again and thoroughly recommend them. 🚘”

Richard

FAQs about refinancing

Frustrated with your current finance company, or paying too much each month? You may want to consider refinancing over to a new deal. Got more questions? Head over to our FAQs page 👍

How soon can I apply to refinance my car deal?

How soon can I apply to refinance my car deal?

Need to make a change now? You can apply to refinance your current car deal at any time. That said, it’s worth keeping in mind that some lenders will ask that you’ve had your existing loan for a set period (usually at least 12 months) before looking to switch things up.

Does refinancing a car hurt your credit score?

Does refinancing a car hurt your credit score?

Credit scores are affected by a whole host of different things, but refinancing will usually lower your score in the short-term. That’s because your new deal will be considered a new account on your credit report while also adding a new hard search and reducing the average age of your credit.

Don’t worry; this decrease should only be temporary. Once you start making your new loan repayments, your score will start to recover. In fact, if your new deal comes with more affordable repayments – and reduces the chances that you’ll miss a payment – refinancing could even improve your credit score over time.

How many times can you refinance a car?

How many times can you refinance a car?

There’s no limit to the number of times you can refinance a car, but that doesn’t necessarily mean you should be looking to switch to a new deal every year. You’ll likely face penalty charges for ending each agreement early and making a new finance application will temporarily impact your credit score by adding a new hard search to your file. If you choose to refinance with a longer loan term, you’ll also need to pay more in interest.

Can I refinance my car if I have bad credit?

Can I refinance my car if I have bad credit?

Bad credit scores can happen for a range of different reasons. There’s no judgement here; if you’ve missed payments in the past, you might still be able to refinance.

Your options may be more limited and you’re unlikely to have access to the lowest APRs, but there are lenders who specialise in bad credit car finance. You could switch to a loan with a longer term and lower repayments (paying more interest over time) or refinance your PCP balloon payment.

What documents do I need to refinance a car?

What documents do I need to refinance a car?

When applying to refinance your car, you’ll likely need to provide:

- Proof of identity – such as a driving licence or passport

- Proof of income – including bank statements or payslips

- Proof of address – such as a Council tax statement or utility bill

- Proof of insurance

- Proof of settlement figure amount

- Vehicle registration documents

Will my monthly payments decrease if I refinance my car?

Will my monthly payments decrease if I refinance my car?

One of the biggest reasons why you might be tempted to refinance your car is to reduce your monthly payments. Maybe you’ve had a change in circumstances, your expenses have gone up, or you’d just like to save a little more each month if you can.

If reduced monthly payments are your priority, you might be able to refinance with an extended loan term that spreads the cost of your finance over a longer time, although this will likely cost you more in interest overall.

You may also be able to lower your monthly payments if your credit score has improved since you signed your original loan agreement and you’re now eligible for a loan with a lower interest rate.

Can I refinance with the same lender?

Can I refinance with the same lender?

While most refinancing loans will be from a new lender, you might be able to refinance with your existing lender if they have an option that suits you and your current circumstances.

Takes 60 seconds, no impact on your credit profile to see if you're approved 👍

Rates from as low as 6.9% APR, Representative 13.9% APR

.webp?width=832&height=592&name=customer-support%20(1).webp)

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)