-

How It Works

-

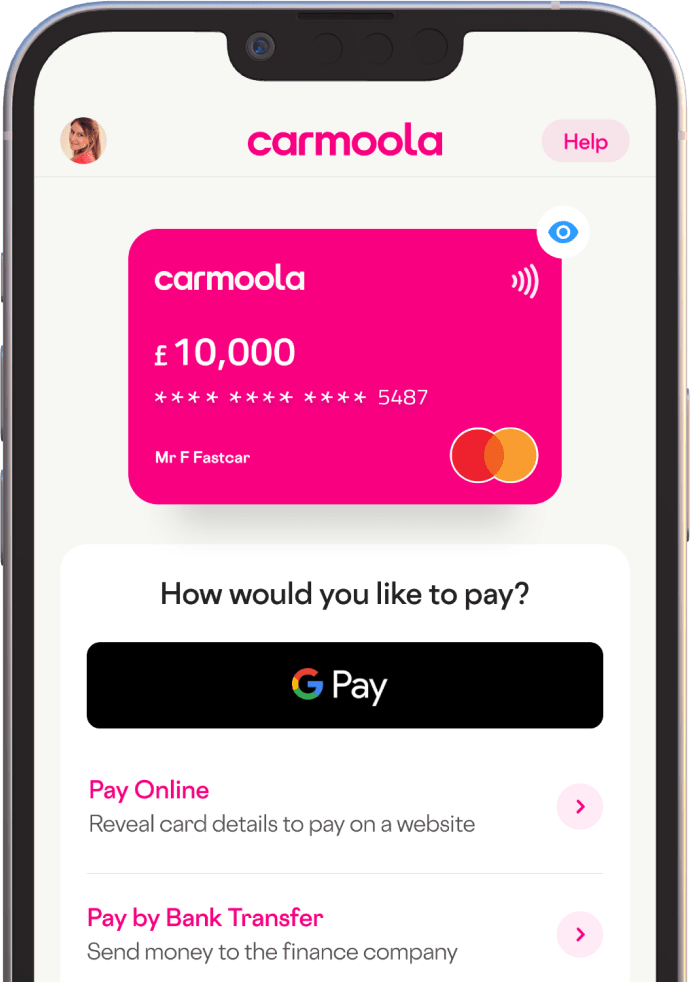

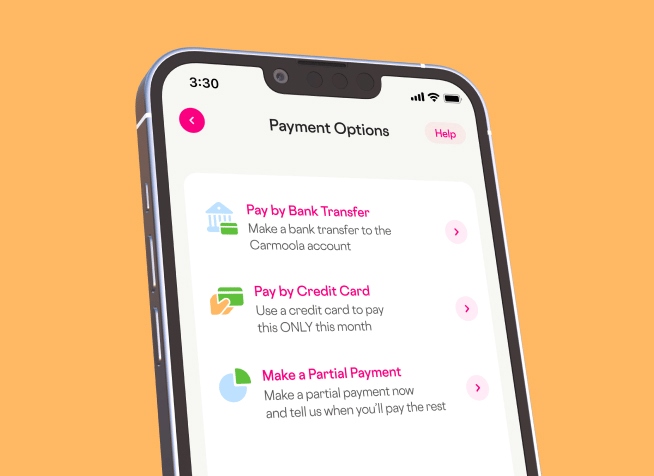

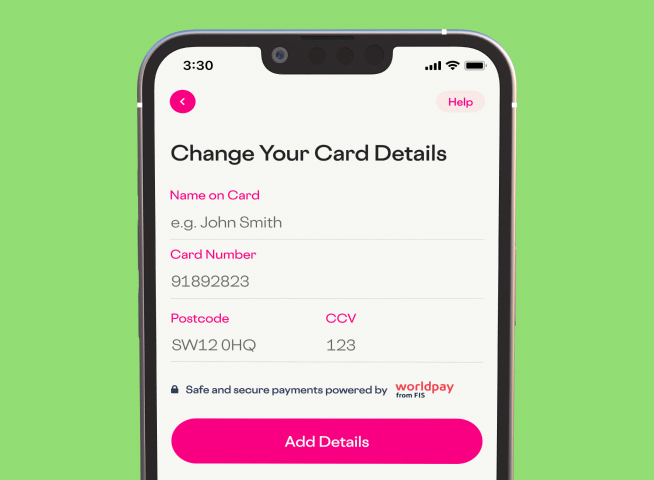

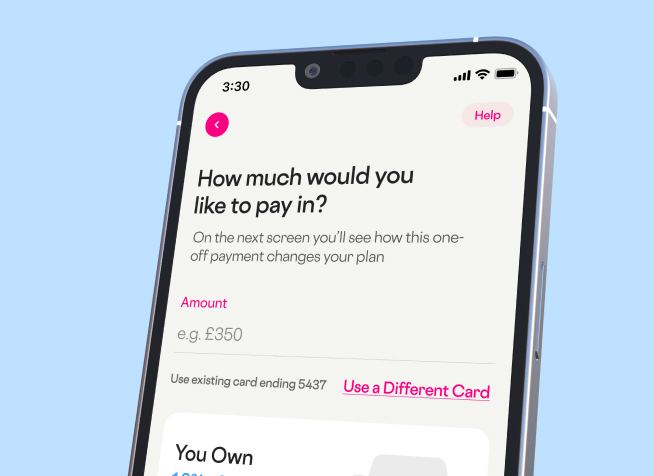

How Carmoola Works

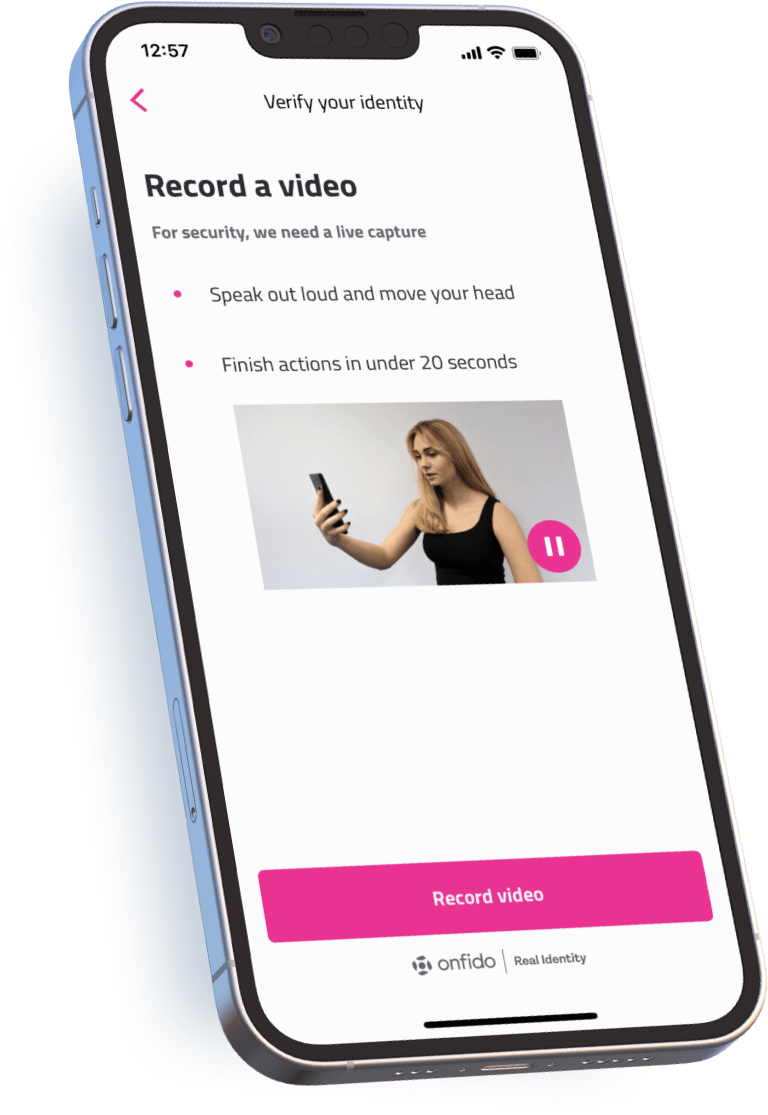

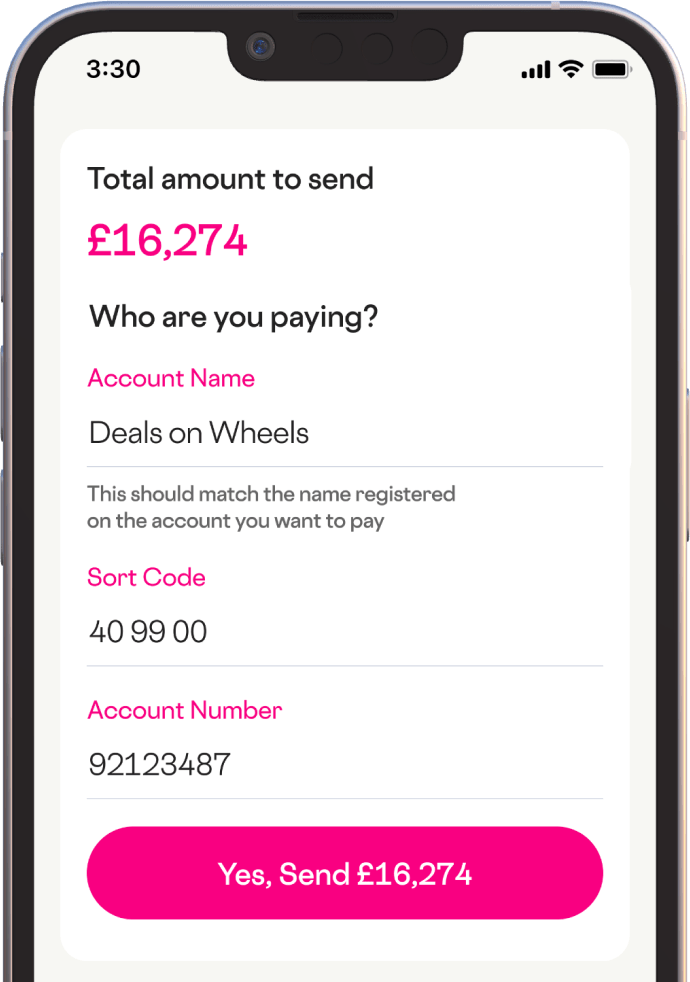

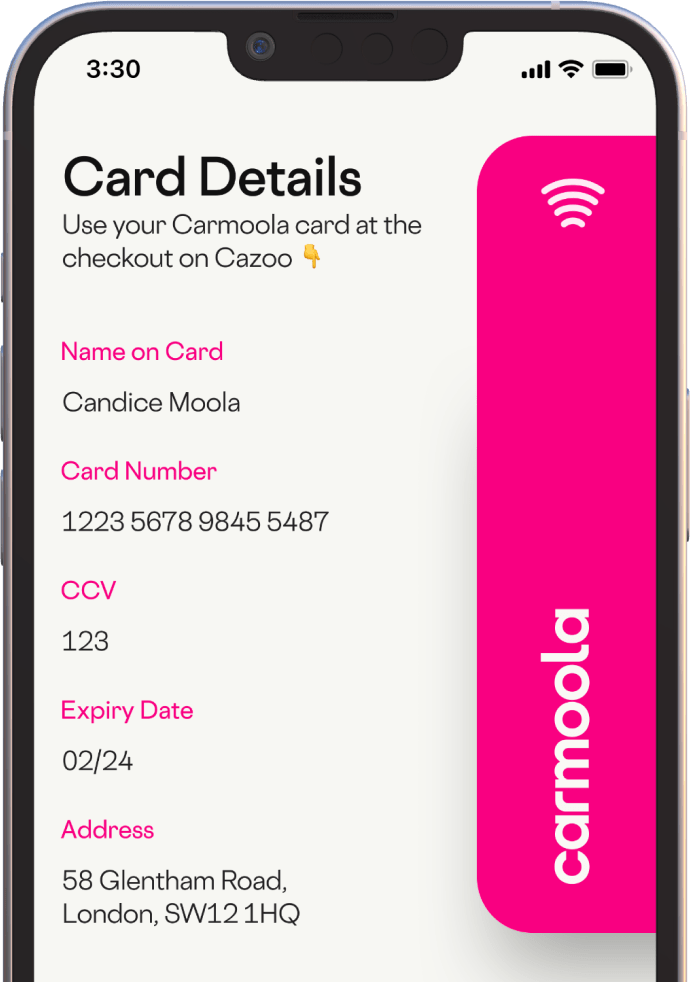

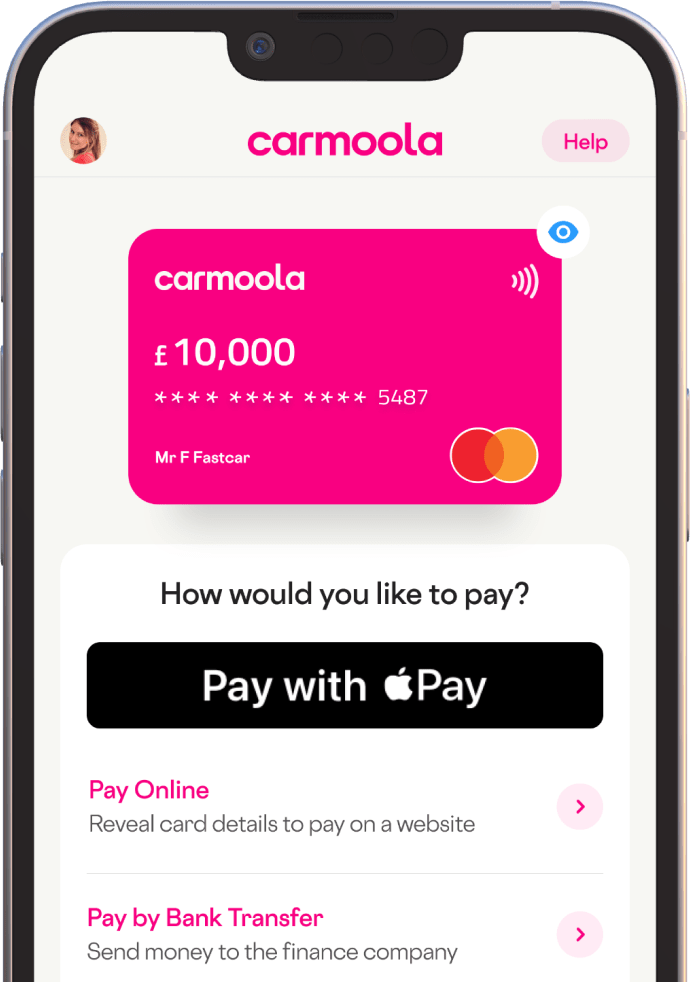

How It Works

Find out how our app works. Within a few minutes you’ll be one step closer to your new car.

Approved Dealerships

Whether you’re buying online or direct from a dealership, we’ve got you covered.

FAQs

Everything you need to know about using Carmoola and car finance.

Want to learn more?

Reviews from our lovely customers

See what other people say about their Carmoola experience.

.webp?width=832&height=592&name=customer-support%20(1).webp)

Get in touch

Our UK based support team are online 8am - 9pm every day.

Join our Approved Dealership network

Apply now to get access to thousands of Carmoola customers.

Depreciation index

Clearly and colourfully make sense of which cars hold their value the best —and those that might have dropped like a stone.

-

-

Car Finance

-

Car Finance

Hire Purchase (HP)

Hire Purchase – or HP – is a type of car finance that lets you spread the cost of a car over an agreed length of time, after which you'll own the car outright.

Personal Contract Purchase (PCP)

Personal Contract Purchase - or PCP - is a flexible finance agreement that allows you to hand the car back, own it outright or trade it in for another at the end.

Refinance

Refinance is the process of taking out a new finance agreement so you can pay off your current loan and switch to a new lender.

-

-

Tools

-

Tools

Car Finance Calculator

Our calculator will estimate how much interest you'll be paying and how much your payments might be each month.

Early Settlement Calculator

Use our early settlement calculator to estimate the outstanding amount on your current HP or PCP agreement.

Eligibility Checker

See if you’re eligible for a car loan - it's fast, free and has no impact on your credit score.

-

- Guides

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.png?width=891&height=1507&name=How-works-phone-step-1(X2).png)

.png?width=287&height=260&name=image-mob%20(1).png)